- 主頁

- News

Newsletters

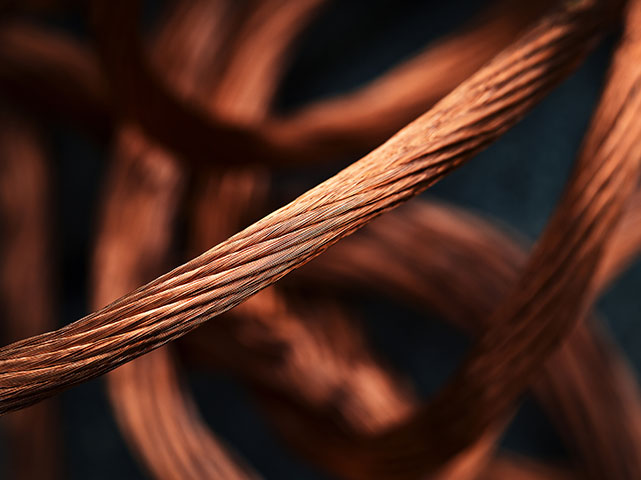

Copper Prices Reaching Record Highs

2 月 2021

NATURAL RESOURCES...

APAC Metals and Mining Deals Up

2 月 2021

NATURAL RESOURCES...

Rare Earth Elements (REE) Market Growing

2 月 2021

NATURAL RESOURCES...

Greater Asia Home to Half of the World’s Biggest Mining Companies

12 月 2020

NATURAL RESOURCES...

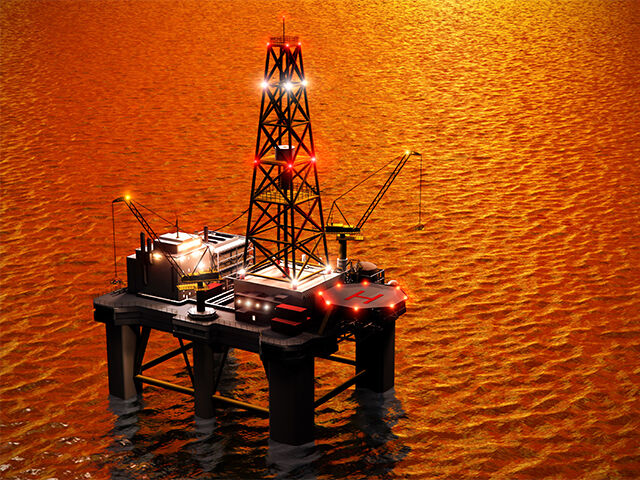

IEA predict U.S. will account for most of world oil’s output growth over next decade

5 月 2020

The International Energy Agency (“IEA”) has said it expects the U.S to account for more than 80% of global oil production growth over the next 10 years and to produce 30% more gas than Russia in the same period. Speaking at ‘COP-23’ the UN Convention’s on climate change, taking place in Bonn, Germany, IEA head Fatih Birol, said the United States, whose upstream energy industry has seen a resurgence with the development of fracking technology, would become the “undisputed leader of oil and gas production worldwide” and that “this has implications for the oil markets, prices, trade flows, investment trends and the geopolitics of energy,” He said the IEA expected oil markets to rebalance in 2018 if oil demand remained “more or less” as robust as it was now and if the Organization of the Petroleum Exporting Countries (“OPEC”) and its allies extended output cuts.

London Metal Exchange sets out strategic pathway to drive growth

10 月 2017

The London Metal Exchange and LME Clear (together, “LME”) have set out their strategic pathway in response to its users views on its discussion paper on market structure. As part of its strategic pathway the LME has identified matters for immediate action as well as matter for development in the longer term. Among the matters for immediate action, the LME will reduce carry fees and intends to introduce a new financial over the counter OTC fee with effect from 1 January 2018 to ensure fairness in LME fee structures.

Barrick Gold Corp and Shandong Gold Mining finalize Veladero joint-venture

7 月 2017

On 30 June 2017, Barrick Gold Corporation (Barrick) announced the completion of the sale of a 50% interest in its Veladero mine in San Juan province, Argentina to Shandong Gold Mining Co., Ltd, (Shandong Gold) for US$960 million. Shandong Gold was listed on the Shanghai Stock Exchange in 2003 and 2016 had produced approximately 1.2 million ounces of gold. It is currently the only Chinese mining company categorized as a National Environmentally Friendly Enterprise by the Chinese Government. Following the sale Barrick and Shandong Go will form a 50/50 joint venture, which will explore and jointly develop the Pascua-Lama deposit and the El Indio Gold Belt on the border of Argentina and Chile.

New Myanmar mining law to incentivise foreign investment in Myanmar’s mining sector

1 月 2016

On 22 December 2015, the Myanmar Government approved amendments to Myanmar’s 1994 Mines Law (Mining Law). The amendments will become law 90 days from the date of approval. The original Mining Law categorised mining activities as mineral exploration, measurements, production, and large-scale and small-scale mining. The new draft amendments introduce provisions relating to medium-scale production, as well as purifying and trading activities. The licence period for large-scale mining has been extended from five to 15 years whereas the licence period for small-scale mining has been increased from three to seven years. inal Mining Law categorised mining activities as mineral exploration, measurements, production, and large-scale and small-scale mining. The new draft amendments introduce provisions relating to medium-scale production, as well as purifying and trading activities.

Evolution mining seeks to outbid Zijin to acquire phoenix

9 月 2015

ASX-listed Evolution Mining Ltd (Evolution) has made a takeover offer (Evolution Offer) for fellow ASX-listed Phoenix Gold Limited (Phoenix), providing Phoenix’s shareholders with an alternative to the offer made by Zijin Mining Group Ltd (Zijin and Zijin Offer). Evolution currently holds a 19.8% share in Phoenix. The Evolution Offer valued Phoenix’s shares at AU$0.12 each or AU$56.4 million in total which according to Evolution represents a 20% premium to Zijin Offer. The Zijin Offer was conditional upon Zijin securing at least a 50.1% stake in Phoenix.

LME clear launches new Renminbi initiative

8 月 2015

LME Clear, the clearing house of the London Metal Exchange (LME) market, has announced that it will now accept offshore Renminbi (RMB) as eligible cash collateral. The announcement follows regulatory approval for the initiative from the Bank of England. According to SWIFT, the RMB is one of the top five global payment currencies. The initiative highlights LME’s commitment to attract and connect market participants from Mainland China and is an example of strengthening of ties between Hong Kong and London.

MPPE issues invitation to tender in relation to the formation of a storage and distribution joint venture in Myanmar

7 月 2015

Myanmar has issued an invitation to tender to foreign companies in relation to the establishment of a joint venture (JV Company) with the Myanmar Petroleum Products Enterprise (MPPE) for the purposes of importing, storing, distributing and selling oil products. The closing date for tender applications is 20 October 2015. The MPPE will hold a 51% share in the JV Company to be established.

Sino Oil and Gas Holdings confident of receiving beijing approval for mass coal-bed methane production

6 月 2015

Shanxi based Sino Oil and Gas Holdings (Sino Oil) has announced that it expects to receive Government approval for its proposed mass coal-bed methane production project by the end of the third quarter 2015. China is estimated to be home to the world’s third-largest reserves of coal-bed methane, which is largely untapped due to technical challenges and insufficient spending on drilling and infrastructure.

TOGGLE CONTENT HERE